Paying someone but still gaining offers and cashback? Sounds bizarre, right? Yes, but it is all possible with some of the most preferred UPI apps that are commonly used in India. You can gain offers, deals, coupon codes, and a lot more with every payment you make through these money transfer apps. However you may think that these are not dedicated apps, but no, you are wrong; you can trust these listed UPI apps with your money. This is because it is a secure payment solution developed by the National Payments Corporation of India (NPCI) under the guidelines of RBI.

To make financial transactions easier, India’s NPCI introduced the Unified Payment Interface (UPI) in April 2016. This has completely revolutionized the way mobile users handle their finances on the go. Several UPI apps are now available on Android devices to make it even easier. Here is a list of some of India’s most used and trusted UPI apps. You can use these apps to perform UPI transactions from your smartphone or tablet device.

UPI stands for Unified Payment Interface. These applications allow users to send and receive money between bank accounts linked with mobile numbers. Payments and Reception are done on a real-time basis and do not require IFSC instead, the user needs a VPA, which is a Virtual Payment Address. VPS looks something like this yourname@icici etc.

We all know that after demonetization and also covid-19, there were a lot of changes in the modes of payment used by people. A 360-degree change took place in India; now, online payment methods are more commonly used among Indians. These changes are accepted as the transfer of payment in online mode is not just only secure but also more accessible.

Here is a list of UPI apps that can help you with easier payment transactions with a secure network that will keep your data safe and protected from any fraud.

List of Best UPI Apps in India February 2026

Following are a few best UPI apps for android users in India to make their payments and transfers in lesser time and effort. The main thing which most people are concerned about is the security of the transaction, so these UPI apps are the most secure apps to use.

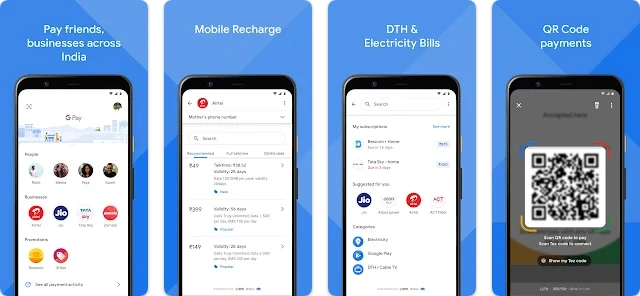

Google Pay: Secure UPI payment

Google Pay is one of the best UPI apps for android users in India, which was formerly known as the TEZ app comes first in the list. Really simple to use and has a very innovative approach, launched by Google in India. This is the first UPI app that enables proximity features (NFC technology) in its platform. Money can be directly transferred to any bank account as no wallet option is available, it offers rewards on transactions, a user-friendly interface, Google Pay Safe Shield, in-app payments for hundreds of partnered merchants, and many more features.

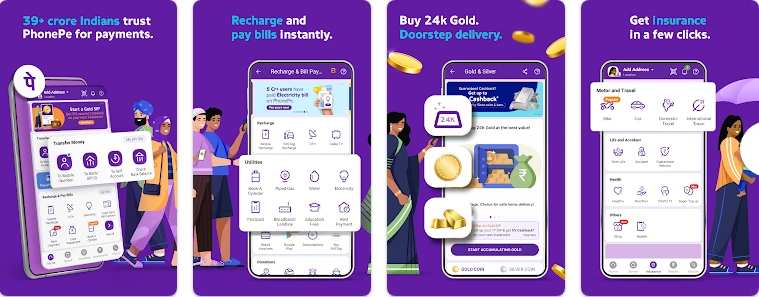

PhonePe UPI, Payment, Recharge

Phone Pe is a Bangalore-based UPI app that was launched in 2016. It is in partnership with Yes Bank to provide UPI payment services in India. This payment app is now acquired by e-commerce giant Flipkart. Its features include excellent rewards on transactions; its interoperability amongst e-wallet providers in India. One can even purchase gold using Phone Pe wallets. Money transfer using UPI limit of up to 1 lakh and includes many other exciting features.

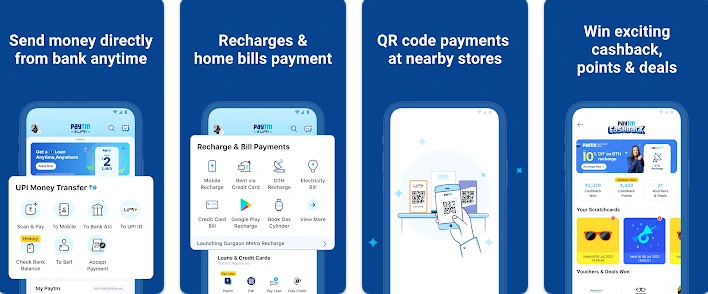

Paytm: Secure UPI Payments

India’s largest digital wallet service provider and most downloaded UPI app on both Android and iOS platforms. Paytm was the pioneer of digital payment service in India and is one of the best UPI apps in India. It offers several services on a single platform. You can link Rupay Virtual Debit Card with Paytm payment bank. It also offers the facility of Paytm mall, and one can purchase many items just like any other e-commerce website. Money transfer using a QR code is also available, and the buy now pay later option is also available for ICICI bank customers.

Amazon Pay

Amazon Pay is one of the most profitable UPI applications. This top UPI app is a digital wallet that you can use to pay for items on the go. You can use Amazon Pay to buy anything from clothes and electronics to food and tickets. The app is dependable, safe, and simple to use. It’s also backed by the world’s most trusted online retailer. Moreover, it’s an Amazon product, therefore it integrates seamlessly with your Amazon account. Plus, the one-touch payment system lets you spend less time checking out and more time enjoying your purchase.

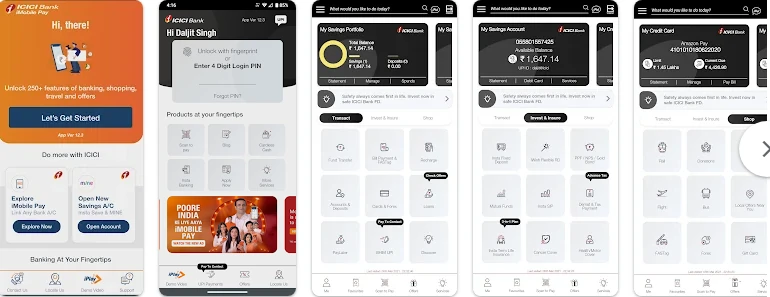

iMobile Pay by ICICI Bank

iMobile Pay is one of the most popular UPI apps in India. It has a simple interface, and it’s easy to make transactions on the go. One of the main reasons people like this app is that it’s free, and you can also set up reminders so you don’t forget to pay your bills. If you have an ICICI bank account, iMobile Pay is definitely worth checking out. The only downside to this app is that limited banking options are available. Still, if you’re looking for a way to manage your finances easily while on the go, then this is an excellent option.

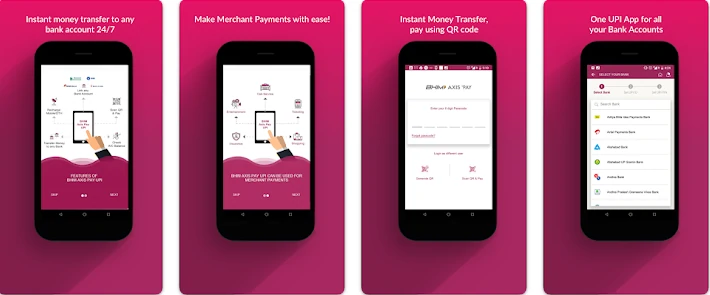

BHIM Axis Pay: UPI, Online Recha

BHIM- Axis Pay UPI is one of the most popular mobile payment apps in India. It is developed by the National Payment Corporation of India (NPCI) and was released to the public on 30 December 2016. BHIM-Axis Pay UPI integrates with all major Indian banks and allow users to send and receive money with their mobile numbers without sharing account details, IFSC codes, or bank account numbers. The app can also be used from any location that has an active data connection.

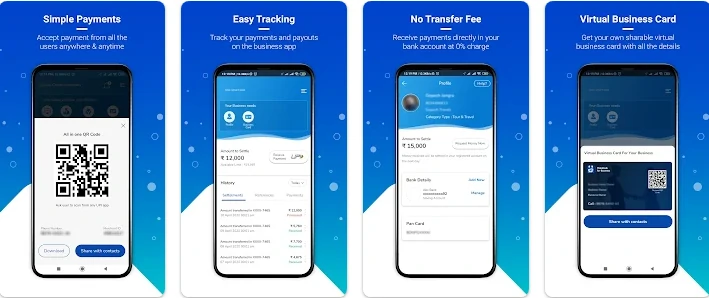

MobiKwik for Business

MobiKwik is a simple and secure mobile app that allows you to make payments anytime, anywhere. The MobiKwik app has a built-in digital wallet where you can store money, pay online, and securely send or receive money. Their goal is to make mobile payments available to everyone. In order to make this happen, they offer an easy registration process, free of charge.

MobiKwik also has more than 8 million customers who have stored more than INR 20 billion in their wallets. The company offers tools like eKYC compliance for businesses and merchants, which helps companies verify customer identities when making mobile phone purchases.

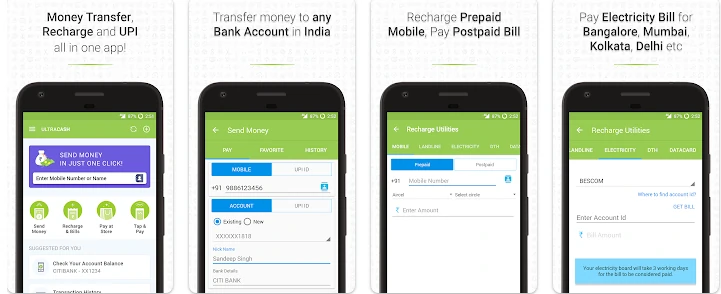

Money Transfer, BHIM UPI

BHIM is the official UPI app of the Government of India. It is a simple and easy-to-use app to send or receive money, as well as make payments or transfer funds. Apart from being a bank account on your phone, BHIM offers financial services that allow you to check your balance, view transactions, and other account details.

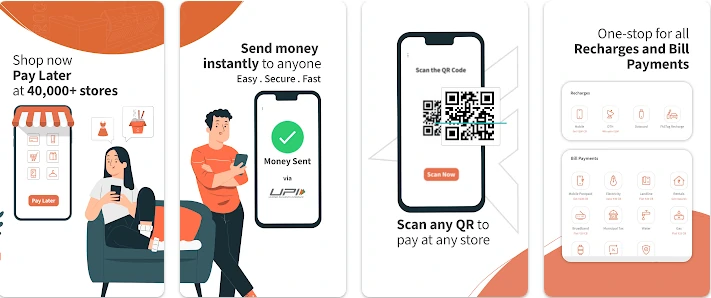

Freecharge – Pay Later, UPI

Freecharge is also a top-rated UPI money transfer app in India that offers several cashback and in-app discounts. Multiple bank accounts can be linked with the number registered in Freecharge, and this app wallet can also be created by fulfillment of KYC. This startup is Gurgaon-based (presently called Gurugram) and has now been acquired by Axis Bank. By using this app, you can also invest in direct mutual funds.

Pockets- Bill Payment, Recharge

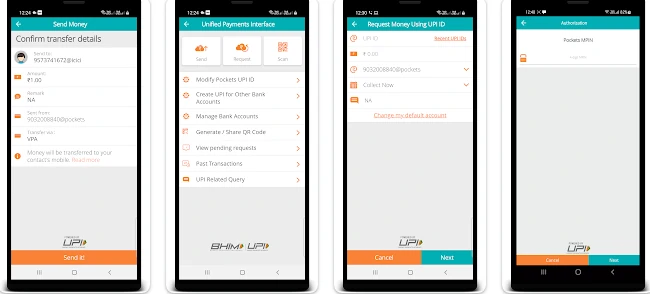

Digital wallet cum UPI payments app offered by ICICI Bank. ICICI bank is considered the most innovative bank among all banks in India, and this Pockets Digital Wallet app is one such innovation. It has many features; you can get a free virtual Visa Debit Card; a virtual digital wallet also allows an option to convert into a savings account. Pockets wallet can also be accessed with ICICI Bank NetBanking. Many discounts and rewards are offered. NFC technology is used. Money transfer through QR code and VPA ID options are available, with a user-friendly interface and much more.

Conclusion: Best UPI Apps for Android users in India

Banks and other financial institutions have been the traditional players in the Indian payment system. But now, technology has given rise to a new player—the Unified Payment Interface (UPI) apps. With the commencement of the online banking systems and UPI facility, it has been more accessible for people to make transactions, creating a Digital India. These apps are among the most popular UPI apps.

With the availability and increased use of online payment modes through UPI and various apps, even the most popular ones, there have been frauds. Hence, you, on your part, need to be careful while making payments and sharing your data. If you are careful, then security on the part of these apps is guaranteed. They are easy to use, offer customizations, and have an intuitive interface. This might be your best bet if you’re looking for a bank-like experience with your payments. These apps are free of charge and offer access to various cashback, discounts on multiple products as well as coupon codes.

The above list includes the most secure money transaction apps that offer user-friendly interfaces and easy and fast transactions with various rewards. One can easily make payments and transfers without the need to stand in long queues. Let us know your chosen UPI app in the comment section.